how to add doordash to taxes

Add your self employment tax to that total and that gives you the total tax. Links to Tax Deductions and Tax Brackets explained down belowhttpsyoutube7CKQb.

How Do I Enter My Income Expenses From Doordash 1099 Nec In Turbotax And Deduction For Tax Return Youtube

The forms are filed with the US.

. I think Stride is for US. Youll go ahead and input your total earnings and any deductions you want to take and the software will calculate what youll owe for you. How to get Tax Slip- Canada.

Pull out the menu on the left side of the screen and tap on Taxes. Tax Forms to Use When Filing DoorDash Taxes. Your total miles are 20000.

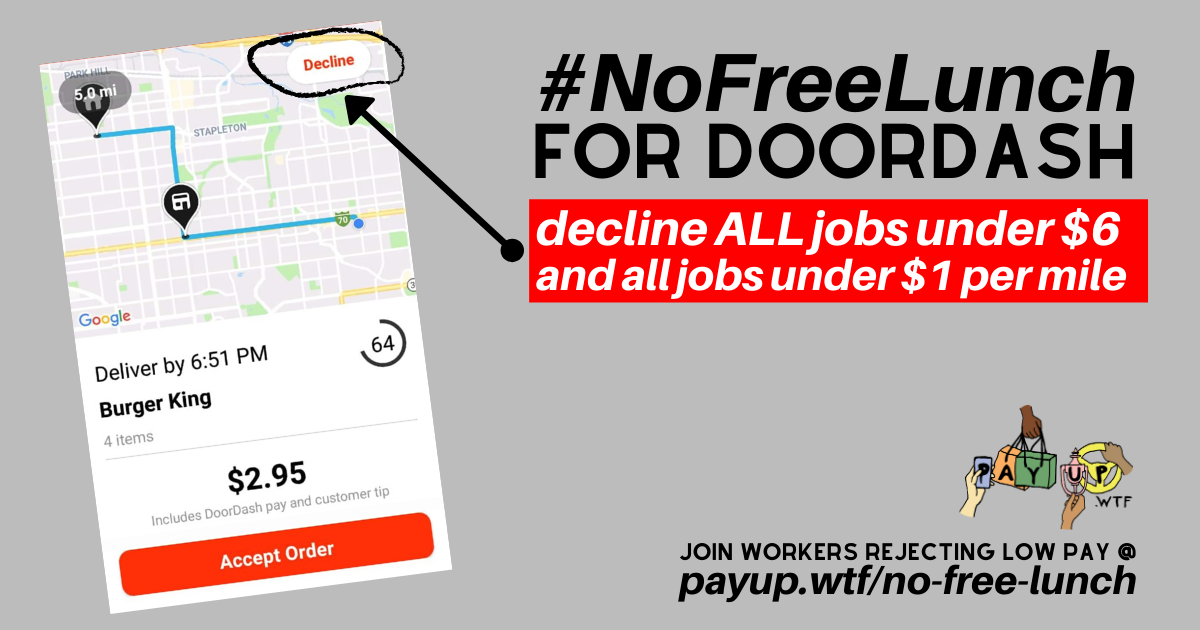

Does DoorDash provide a 1099. You should be keeping track of your work-related mileage. First make sure you are keeping track of your mileage.

Any idea on how to get the tax slipEarnings for DD. Mileage and DoorDash taxes at the end of the year. - If you are eligible for e-delivery you will receive an email invitation the subject of the email is Review your.

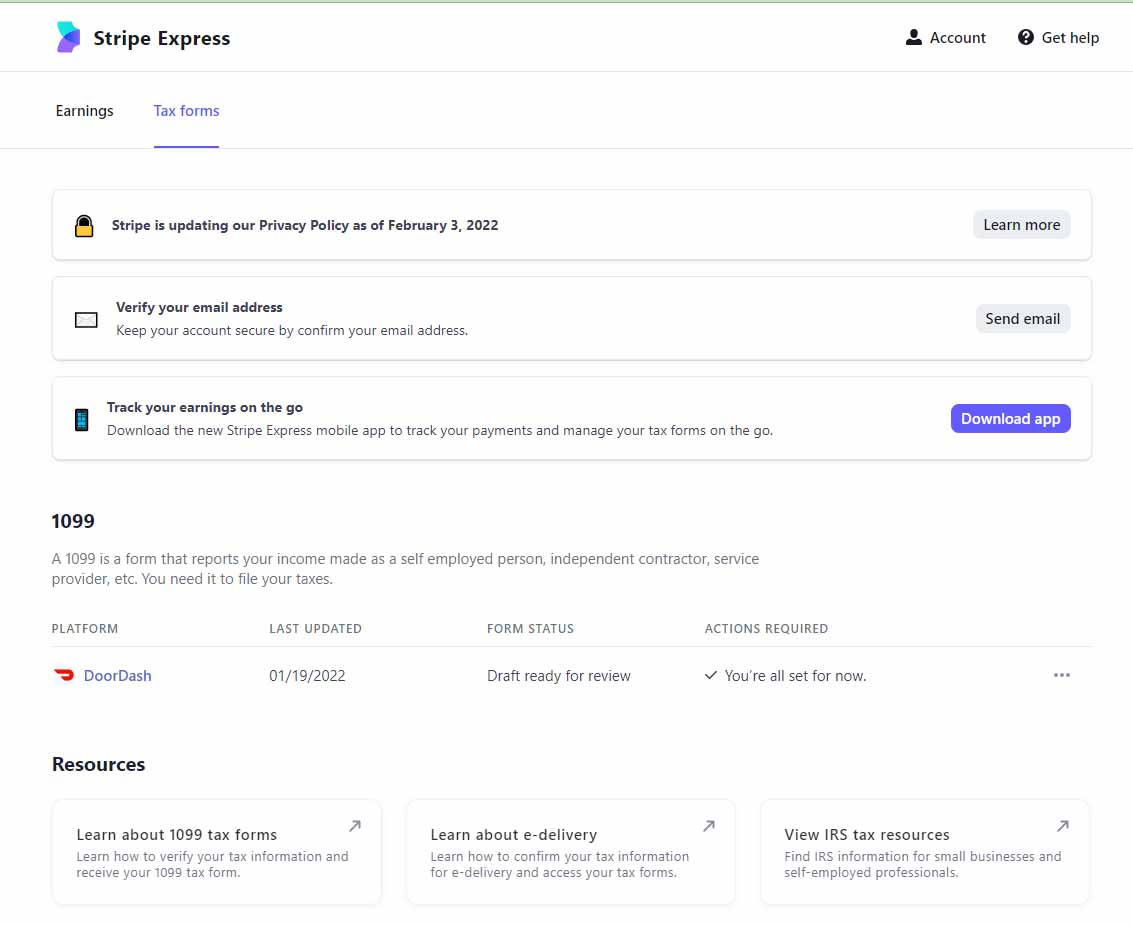

DoorDash sends their 1099s through Stripe. Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. One last step is to multiply that by 935.

A simple way to calculate your roadside assistance tax deduction is to take the total number of all miles you drove for the year and determine what percentage of those miles were for work. Drivers who make more than 20000 with more than 200 transactions will have to file form 1099-K. To file as an employee simply add the wages from your W-2 to line 1 of your tax return.

So if you drove 5000 miles for DoorDash your tax deduction would be 2875. In the next screen. In 2020 the rate was 575 cents.

Dont get caught with your pants down by the IRS. All you need to do is track your mileage for taxes. Because this is a necessity for your job you can deduct the cost of buying the bag at tax time.

The DoorDash income Form 1099misc is considered self employment income. You may also find that you need to purchase other deductible work equipment as well including drink holders or spill-proof covers for your car seats. If youre a Dasher youll need this form to file your taxes.

Keep an eye out for this email and make sure it doesnt go to spam youll. Internal Revenue Service IRS and if required state tax departments. DoorDash drivers are expected to file taxes each year like all independent contractors.

Your total auto expenses are 5000. It may take 2-3 weeks for your tax documents to arrive by mail. Subtract 56 cents per mile that you recorded on your mileage log 2021 tax year 585 for 2022.

This means for every mile you drive you pay 057 less in taxes. Paper Copy through Mail. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021.

Please allow up to 10 business days for mail delivery. Your total business miles are 10000. 5000 x 5 2500 which is the amount you can claim.

That may not seem like much but in a typical day can save you 28 57 or more depending on how much you drive. How to File DoorDash Taxes. Theyve used Payable in the past In early January expect an email inviting you to set up a Stripe Express Account.

Get cashback for gas. Youll input this number into your Schedule C to report Gross Earnings on Line 1. Your 1099 tax form will be available to download via Stripe Express.

When using the mileage method. You can do this with one of the many. Form 1099-NEC reports income you received directly from DoorDash ex.

Incentive payments and driver referral payments. The income as well as expenses including your vehicle can be entered by following the information below. Add up all your Doordash Grubhub Uber Eats Instacart and other gig economy income.

A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. 10000 20000 5 or 50. Now you add up all of your payments.

TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. E-delivery through Stripe Express.

For 2020 the mileage reimbursement amount is 057. Also on the Schedule C youll mark what expenses you want to claim as deductions. Payments include W2 withholding estimated tax payments you made through the year and refundable credits.

We are in Q4 of 2019. DoorDash will file your 1099 tax form with the IRS and relevant state tax authorities. Each year tax season kicks off with tax forms that show all the important information from the previous year.

Using tax software like Turbo Tax. Note that if youre accessing the site from a web browser you need to click on Taxes in the bar at the top. My Account Tools Topic Search Type 1099misc Go Enter your 1099misc and follow the prompts My Account Tools Topic Search Type vehicle expenses.

DoorDash will send you tax form 1099-NEC if you earn more than 600. DoorDash requires all of their drivers to carry an insulated food bag. You can quickly determine the total number of miles that you drove for work if you use a mileage tracker app like Falcon Expenses.

Please note that DoorDash will typically send. Effective in 2018 employees may not deduct unreimbursed expenses as itemized deductions. Your 1099 tax form will be mailed to you if you dont receive an email from Stripe or dont consent to e-delivery.

If your total payments are greater than your total tax bill you get the difference as a refund. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash. Doing your own taxes.

Take note of how many miles you drove for DoorDash and multiply it by the Standard Mileage deduction rate. I called DD and they said would have got an email from Stride in income more than 600 but I have got any yet.

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

1 5 Inch Personalized Custom Doordash Uber Eats Grub Hub Etsy Thank You Stickers Personalized Custom Personalized Stickers

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Tax Guide What Deductions Can Drivers Take Picnic S Blog

Guide To 1099 Tax Forms For Doordash Dashers And Merchants Stripe Help Support

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Doordash Tax Guide What Deductions Can Drivers Take Picnic S Blog

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher

How To Get Doordash Tax 1099 Forms Youtube

How To File 1099 Taxes Properly Uber Doordash Lyft Etc Youtube

How Does Doordash Do Taxes Taxestalk Net